FXRISK

Delivering real-time visibility into currency exposures,

hedging positions, and overall risk, enabling smarter,

data-driven decisions.

It empowers Treasury Outsource Companies to monitor market movements, manage complex hedge

strategies, and proactively mitigate risk with streamlined workflows and reliable, validated information.

FXRISK

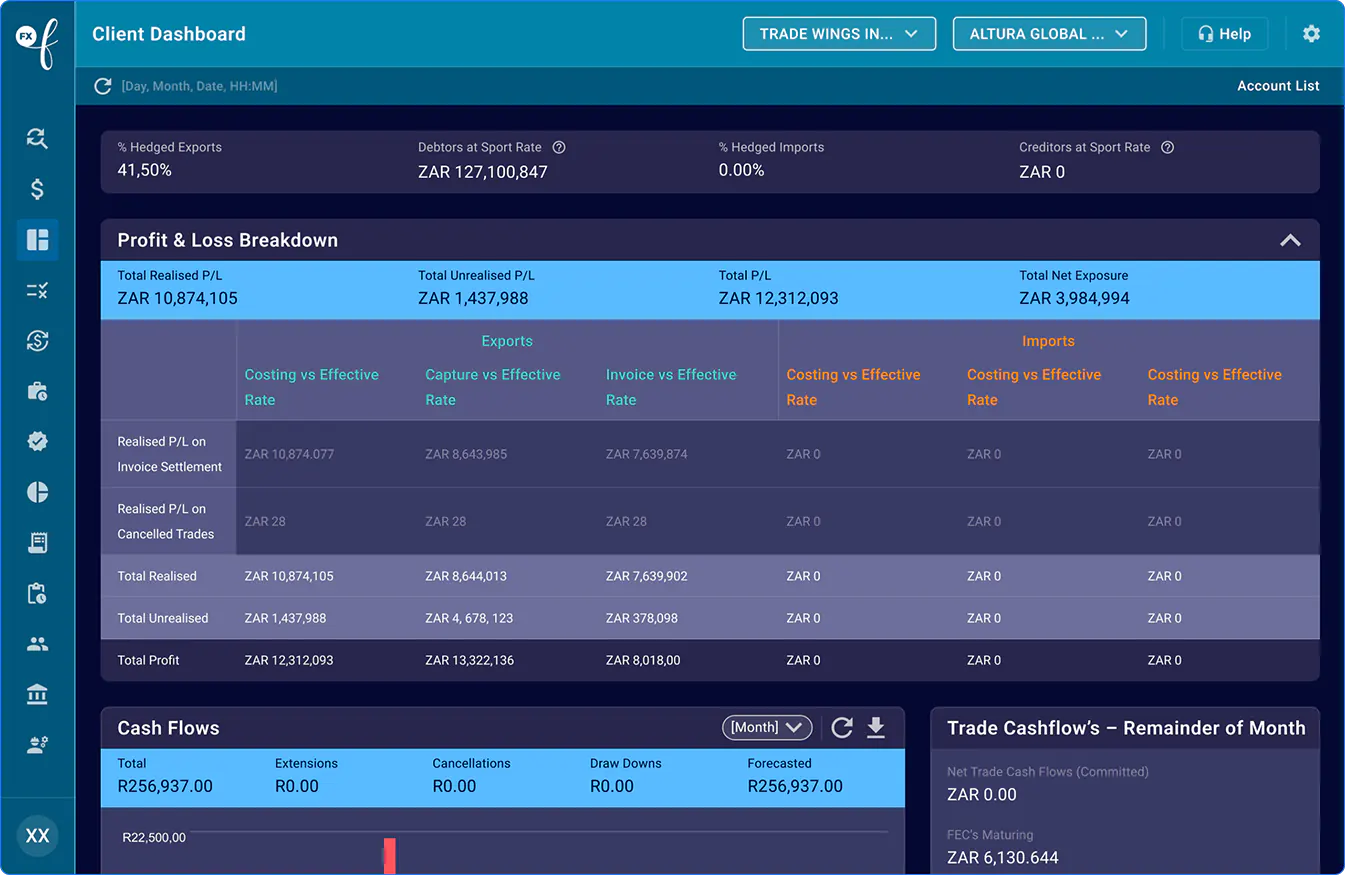

Delivering real-time visibility into currency exposures, hedging positions, and overall risk, enabling smarter, data-driven decisions.

It empowers Treasury Outsource Companies to monitor market movements, manage complex hedge strategies, and proactively mitigate risk with streamlined workflows and reliable, validated information.

FXRISK KEY BENEFITS

FXRISK

KEY BENEFITS

& Settlements

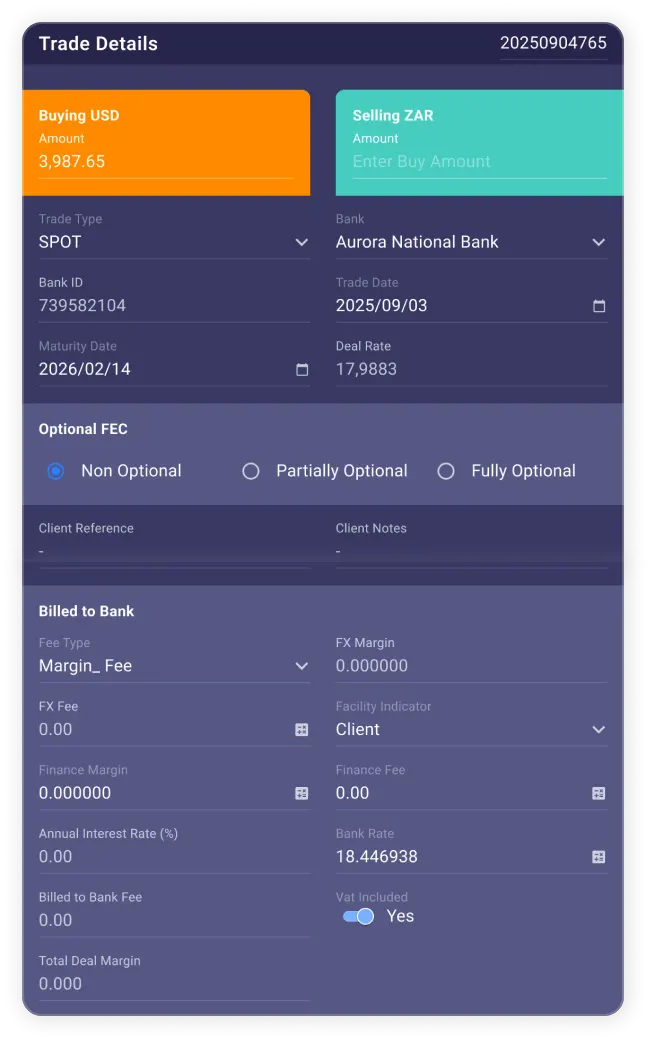

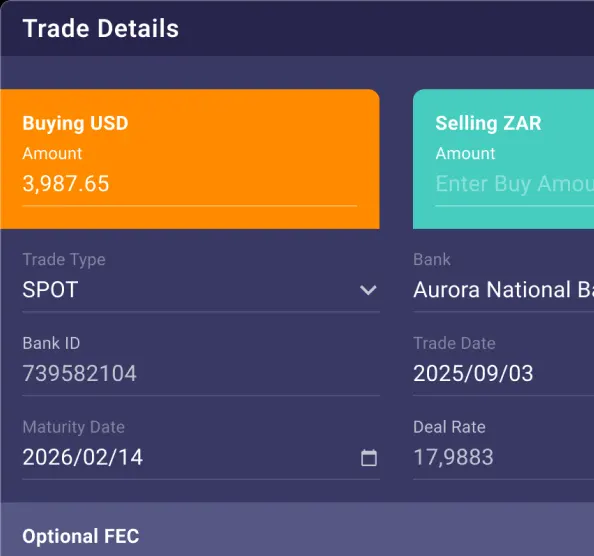

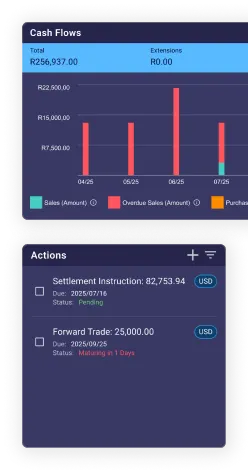

Provides stronger risk oversight by giving real-time visibility of currency exposures and hedge links, enabling confident management of client positions and accurate profit-and-loss outcomes.

Management

Supports better decision-making with clear, actionable insights

and automated trade capture

from bank confirmations,

reducing manual effort and ensuring revenue, fee and commission calculations are consistent and reliable.

Management

Enhances credit and margin control by showing consolidated and client-level facility utilisation, helping users avoid margin calls and plan hedging capacity

with confidence.

Management

Enhances credit and margin control by showing consolidated and client-level facility utilisation, helping users avoid margin calls and plan hedging capacity

with confidence.

& Reporting

Simplifies client service by providing instant access to accurate positions, mark-to-market valuations, and benchmark comparisons, facilitating transparent performance tracking against market rates.

& Reporting

Simplifies client service by providing instant access to accurate positions, mark-to-market valuations, and benchmark comparisons, facilitating transparent performance tracking against market rates.

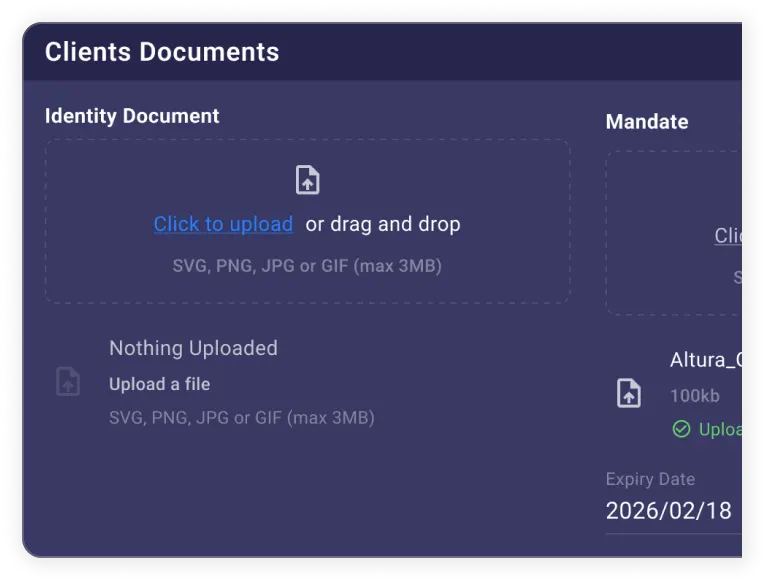

Confirmation

Improves data integrity and accuracy through validated, automatically generated confirmations that align with bank records and reduce reconciliation errors.

Feeds &

Automation

Enables faster, more informed decisions by combining live market rates with streamlined workflows that minimise manual input and keep valuations current in a dynamic FX environment.

FXRISK UNIQUE ATTRIBUTES

FXRISK

UNIQUE ATTRIBUTES

Treasury Outsourcing

Companies

Designed around the complex operational realities of TOCs and their clients, delivering functionality that generic treasury systems cannot match.

Facility Management

Offers industry-leading facility tracking, including consolidated TOC oversight and granular per-client utilisation, enabling unmatched control of credit and margin exposure.

Automation

Dramatically reduces manual effort through automated trade capture, fee calculation, and bank-aligned validations, ensuring consistent and reliable results at scale.

Automation

Dramatically reduces manual effort through automated trade capture, fee calculation, and bank-aligned validations, ensuring consistent and reliable results at scale.

Data

Integrates directly with bank confirmations to provide trusted, accurate information throughout the risk management process.

Data

Integrates directly with bank confirmations to provide trusted, accurate information throughout the risk management process.

Platform

Combines exposure monitoring, hedging, facility control, and performance analytics in a single, integrated environment, eliminating the need for fragmented or partial solutions.

OTHER OFFERINGS

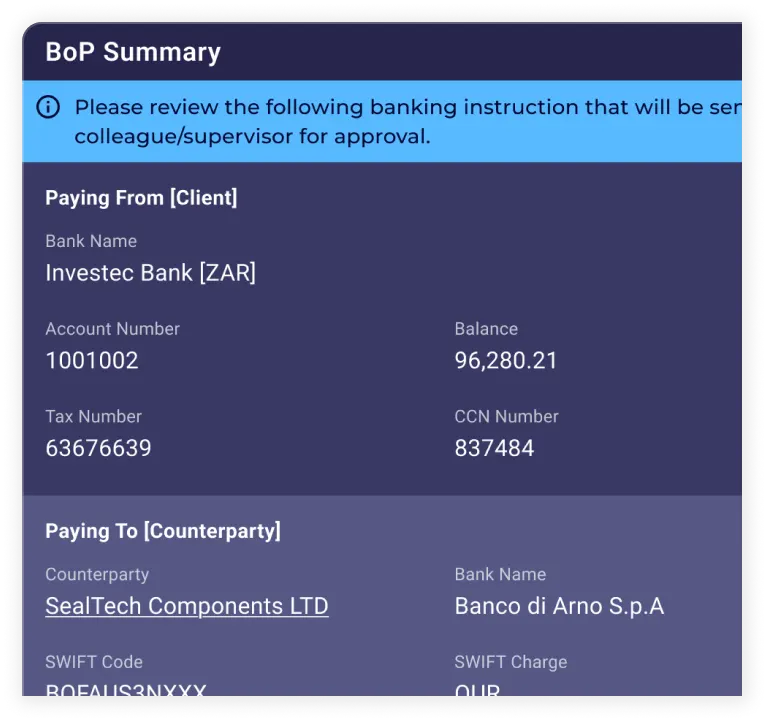

Automation of FX Payment Execution

Streamline FX transactions with seamless bank integration, minimise documentation transfers, and eliminate double data handling.

Client and Consolidate Views

Efficient client handling, seamless partner management, and automated billing – freeing you to focus on delivering value.

PARTNER WITH FXFLOW

FXFlow is part of the 42Markets Group, a specialist FinTech Group, whose companies have decades of experience and deep expertise in Trade and Treasury in Financial and Capital Markets.

FXFlow is part of the 42Markets Group, a specialist FinTech Group, whose companies have decades of experience and deep expertise in Trade and Treasury in Financial and Capital Markets.