OFFERING

FX Pay Module

Simplify foreign payments and receipts - secure, compliant, and efficient straight-through processing to server your clients better.

SEE HOW IT WORKS

Try it now! Sign up for your

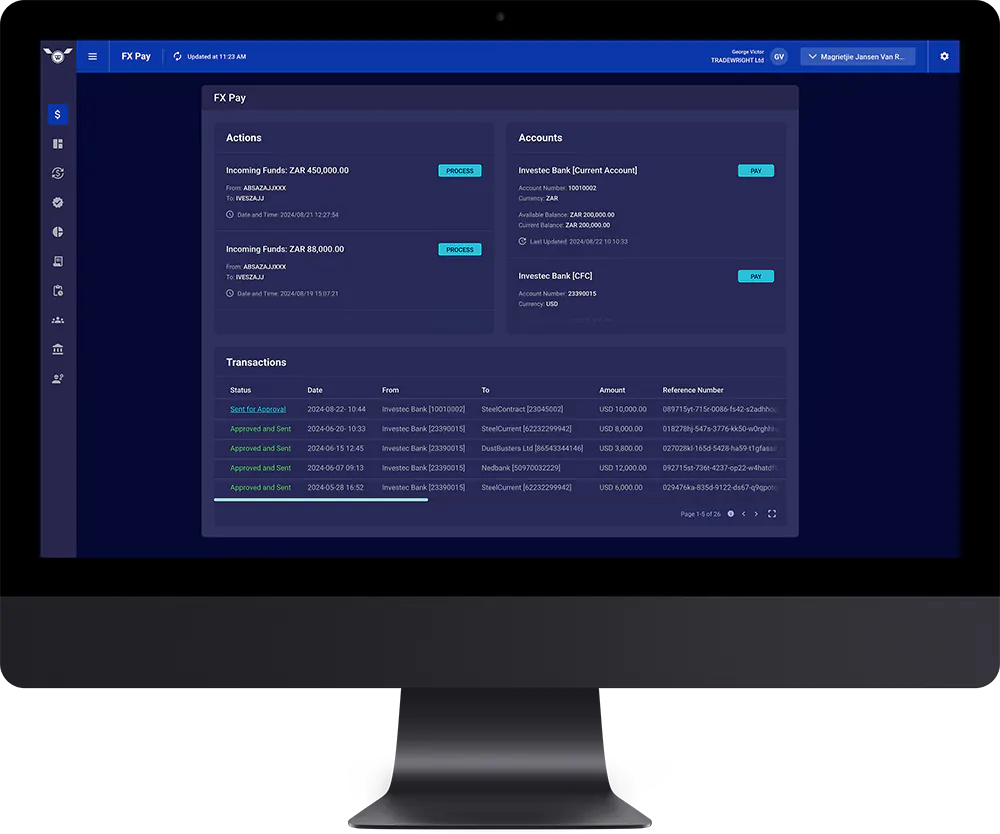

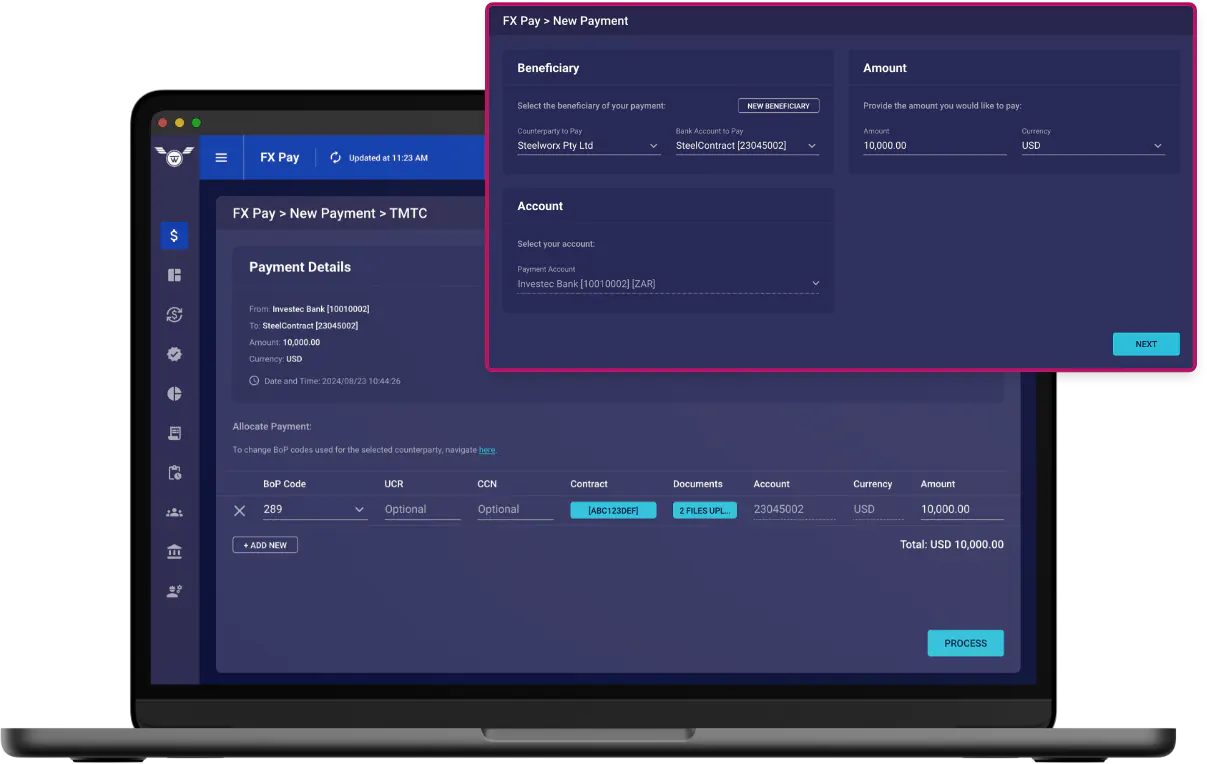

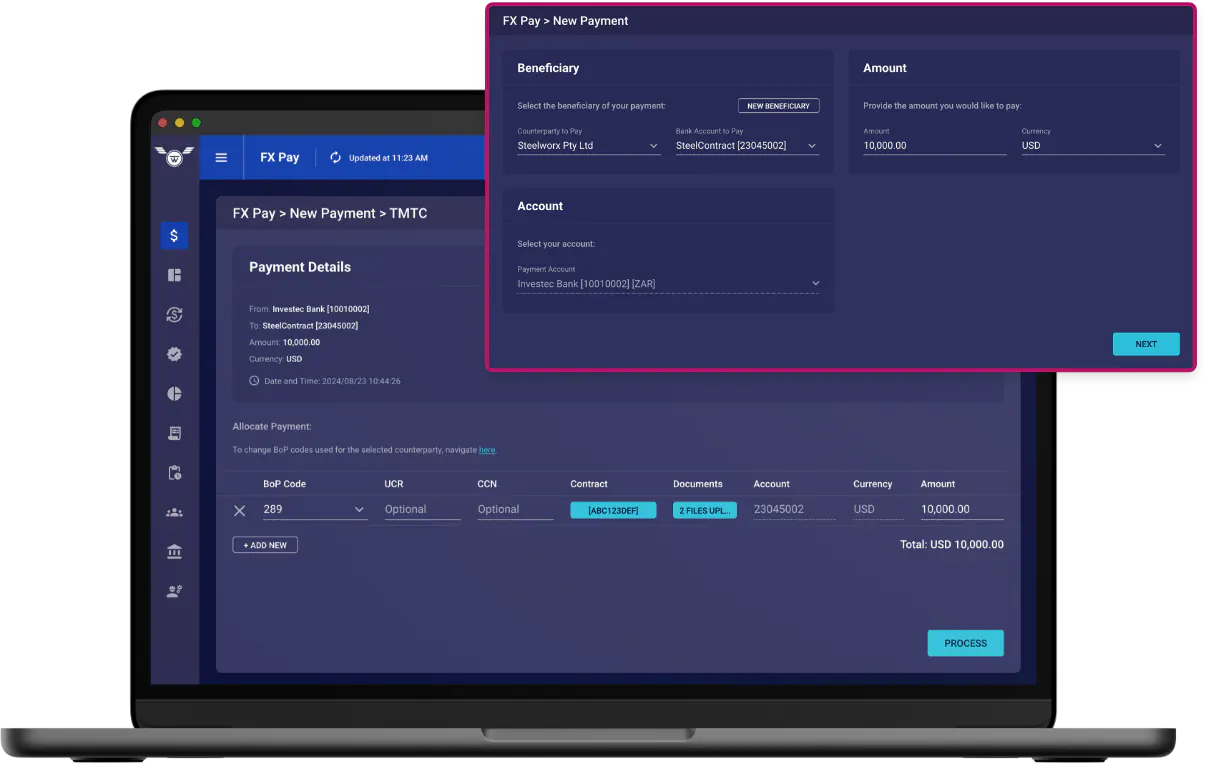

FX Pay is a feature within FX Flow that automates and streamlines foreign payments and receipts, reducing manual efforts and minimising errors.

By integrating seamlessly with bank APIs, it ensures efficient, compliant, and accurate transactions. FX Pay addresses the challenges of managing complex FX transactions, enabling businesses to process payments directly within the system and eliminate the need for external platforms.

Management

Easily oversee all foreign payments and receipts requiring action from your clients, with a centralized dashboard that consolidates every pending transaction. This feature allows TOCs to manage multiple client requests efficiently, ensuring timely processing while maintaining complete control over all transaction activities.

Management

Easily oversee all foreign payments and receipts requiring action from your clients, with a centralized dashboard that consolidates every pending transaction. This feature allows TOCs to manage multiple client requests efficiently, ensuring timely processing while maintaining complete control over all transaction activities.

FOR USING FX PAY

Drive Revenue Growth

FX Flow enables you to handle larger transaction volumes effortlessly, allowing your team to focus on scaling your business while maintaining exceptional service quality. Efficient workflows let you serve more clients and unlock new opportunities for growth.

Drive Revenue Growth

The system’s automation reduces the need for manual interventions, saving both time and money. By minimising delays and avoiding costly errors, FX Flow helps lower operational expenses, improving your bottom line.

Drive Revenue Growth

FX Flow ensures compliance with SARB and global regulations through automated BOP

reporting and secure workflow management. This reduces the risk of regulatory penalties and ensures accurate, auditable transaction records, giving you peace of mind in managing compliance.

Enjoy top-tier security, seamless transitions, and precise data conversion - all at unbeatable prices.

Need more info?

FAQs

FX Flow simplifies foreign payments and receipts by streamlining workflows, providing faster processing, and maintaining compliance—all while keeping your team in control of key decisions

FX Flow guides your team through the compliance process, ensuring documents and BOP information is correctly managed, helping to meet SARB and other regulatory standards with less manual effort.

FX Flow offers secure workflows with clear roles and permissions, ensuring that sensitive information is handled safely, with full visibility and control for your team.

Yes, FX Flow supports growing volumes by simplifying workflows and leveraging innovative cloud technologies, allowing your team to manage more transactions without adding extra resources, while maintaining accuracy and control.

For more information or to book a presentation, please contact our