OFFERING

Risk Management

Confidently manage FX risks with real-time P&L tracking, governance tools, and seamless integration to streamline operations.

SEE HOW IT WORKS

Try it now! Contact our

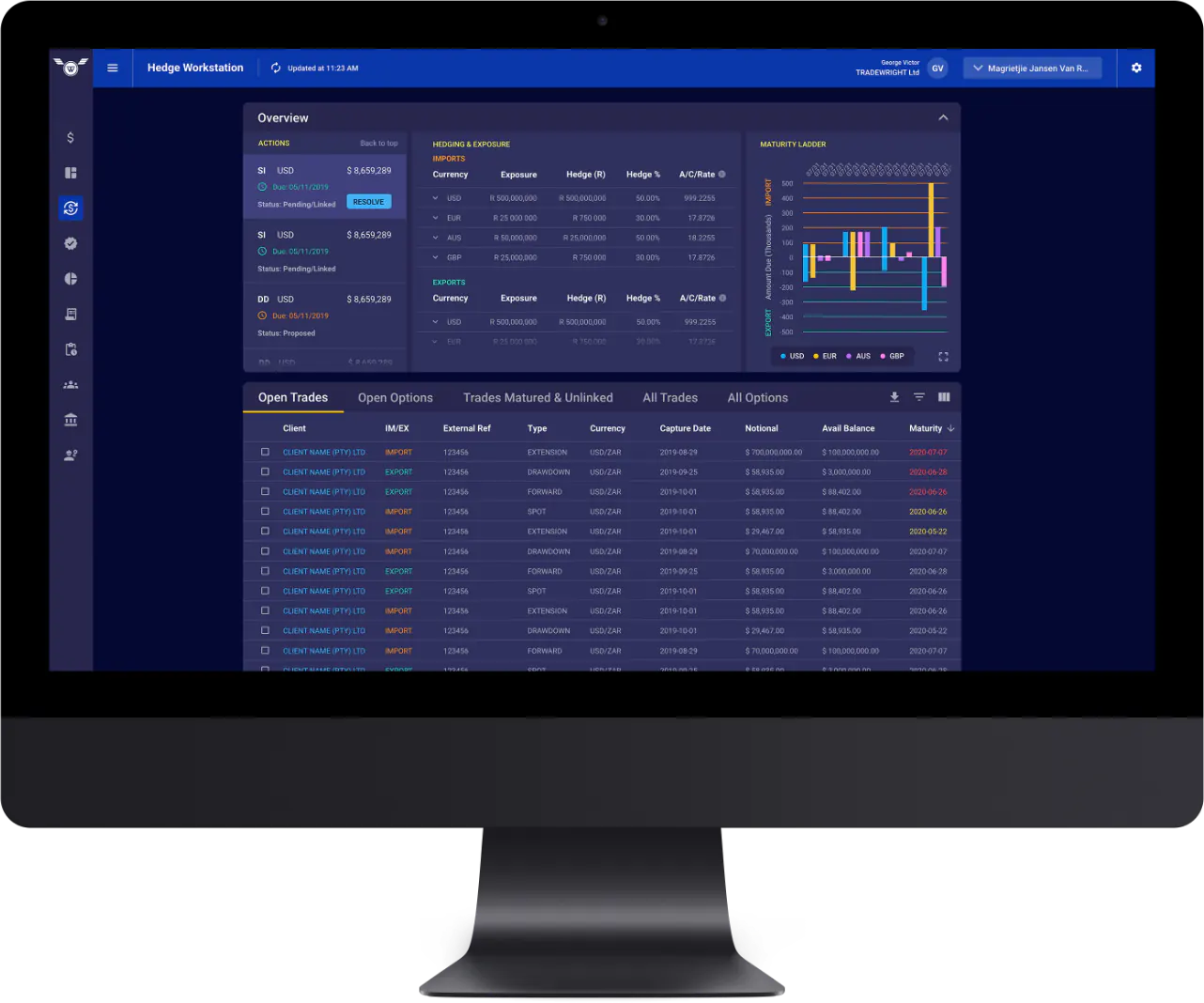

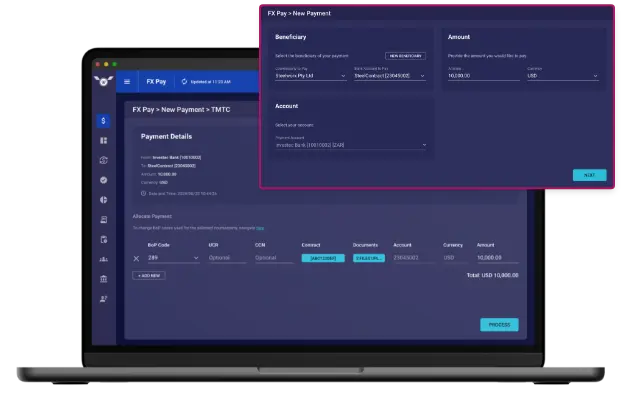

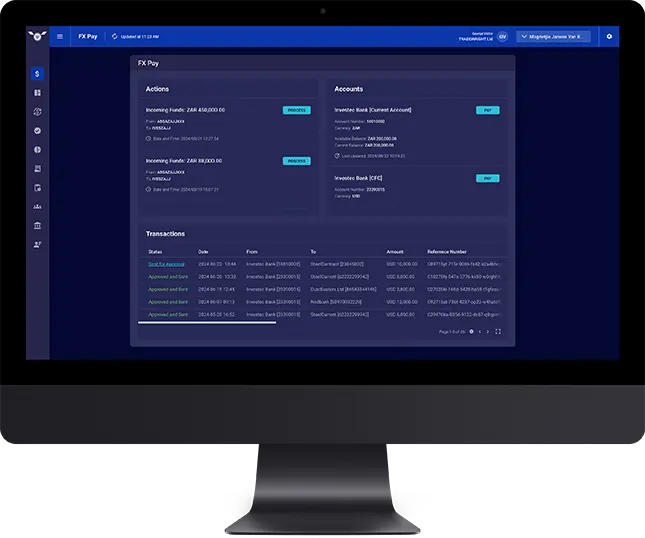

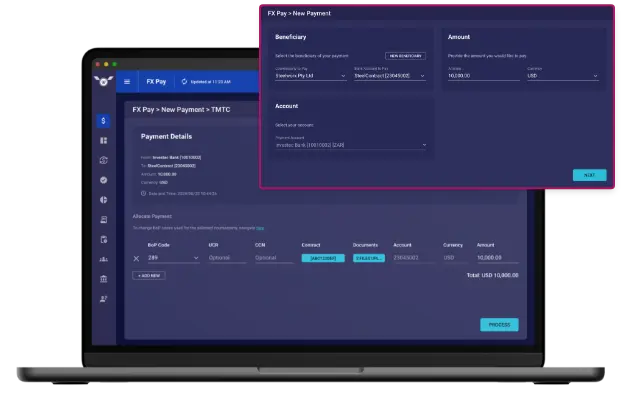

FX Flow Risk Management provides a comprehensive platform with detailed reporting designed to help Treasury Outsourcing Companies (TOCs) manage foreign exchange exposures on behalf of clients.

Real-Time P&L Tracking

FX Flow provides consolidated, real-time P&L tracking by currency pair, allowing users to see mark-to-market calculations and transaction summaries with drill-down functionality. This feature helps businesses monitor and manage their FX exposures effectively.

Advanced Reporting Tools

The system enables the creation of comprehensive reports including billing, option, cash flow and exposure reports, with customisation options to suit specific needs and seamless export for further analysis.

Seamless Integration

Our system seamlessly integrates with multiple banks, absorbing trade confirmations directly into the platform. This ensures that all your trades from various banking partners are visible in one place, providing a unified and clear view of your trade positions, enhancing exposure management and improving oversight.

FOR USING FX FLOW

RISK MANAGEMENT

Real-Time FX P&L Tracking

Monitor profit and loss in real time across

all foreign exchange trades, giving you

up-to-date insights that allow for faster

and more strategic decisions in volatile currency markets.

Customisable FX Reporting

For Greater Precision

Generate and tailor billing, option, and exposure reports specific to your foreign exchange operations, ensuring accurate reporting and deeper analysis for better control of your FX activities.

Centralised FX Trade

Visibility

Integrate FX trade confirmations from multiple banks into one platform, providing a clear, consolidated view of your foreign exchange positions for enhanced exposure management and oversight.

Improved Risk

Management

Continuous access to up-to-date financial data helps TOCs better manage exposure risks by identifying unfavourable positions early, enabling timely interventions to mitigate potential losses for their clients.

Enjoy top-tier security, seamless transitions, and precise data conversion - all at unbeatable prices.

Need more info?

FAQs

FX Flow automates many manual processes through straight-through processing, providing real-time data integration and audit trails that ensure transparency and accuracy, thereby reducing the risk of manual errors.

P&L tracking calculates real-time foreign exchange exposure for each currency and tracks both realised and unrealised P&L. It provides insights at both the client level and TOC level.

For more information or to book a presentation, please contact our