FXINTERMEDIARY

Enabling Treasury Outsource Companies to manage their clients, partners, and revenue through a single, streamlined platform.

It simplifies operations, reduces risk, and ensures accurate billing and oversight across all FX activities.

FXINTER-

MEDIARY

Enabling Treasury

Outsource

Companies to

manage their clients,

partners, and revenue

through a single, streamlined platform.

Enabling Treasury

Outsource

Companies to

manage their clients,

partners, and revenue

through a single,

streamlined platform.

It simplifies operations, reduces risk, and ensures accurate billing and oversight across all FX activities.

FXINTERMEDIARY KEY BENEFITS

FXINTERMEDIARY

KEY BENEFITS

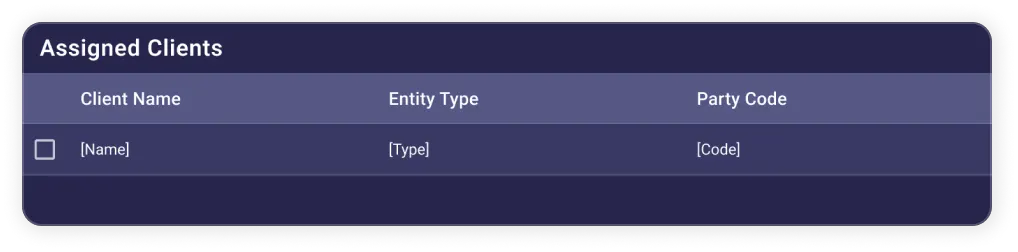

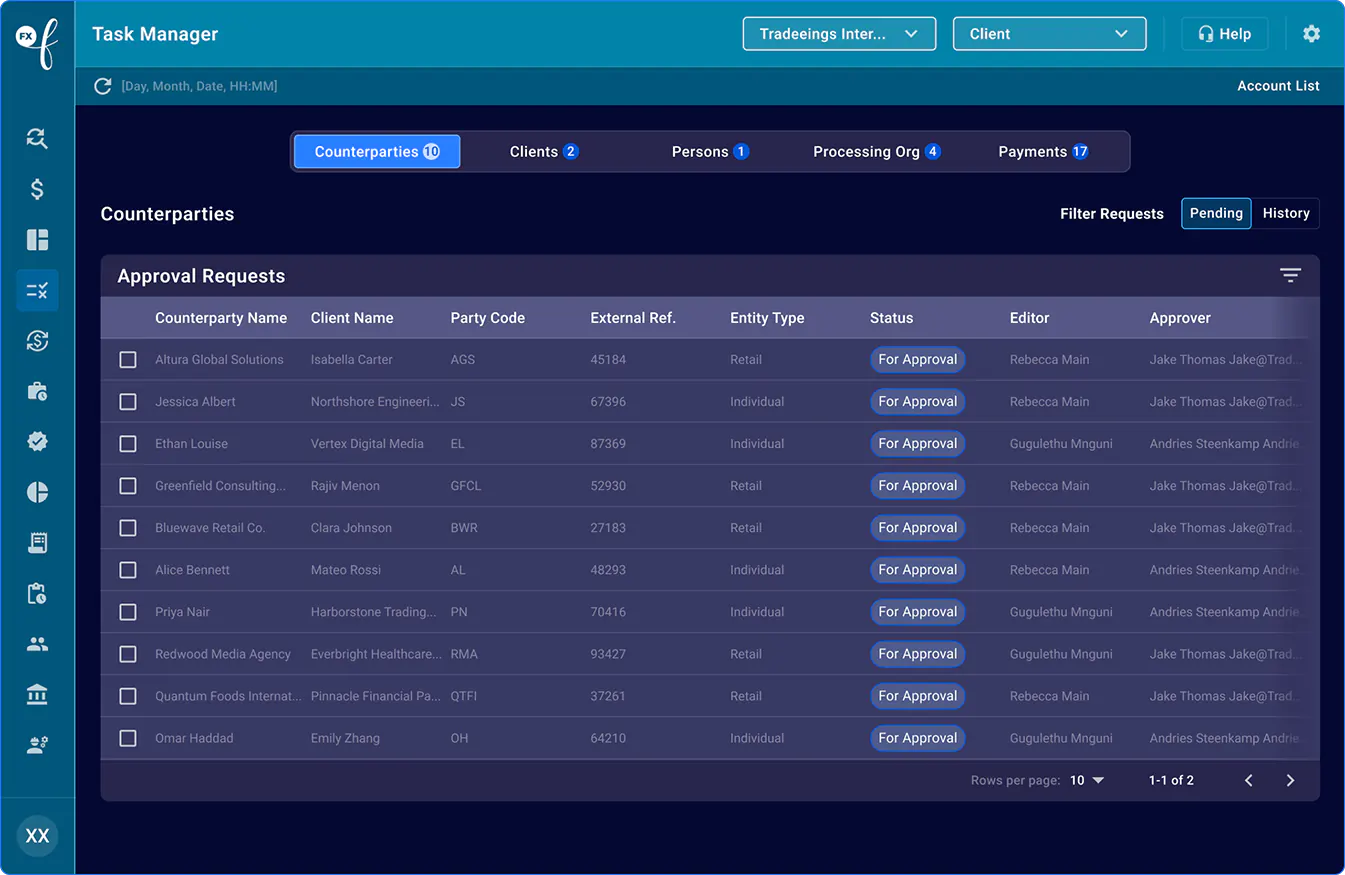

Enables roles and permissions that ensure everyone can access the information most relevant to them, whether at the processing organisation, portfolio, client, or person/partner level.

Setup

Offers tailored branding and white labelling, inclusion of unique organisational attributes, data management at both individual and aggregated levels, seamless bank API integration where available, and consolidated work lists.

Provides template and customised roles, giving users access only to relevant workstations and data while enabling strict operational control and security through tailored permissions.

Management

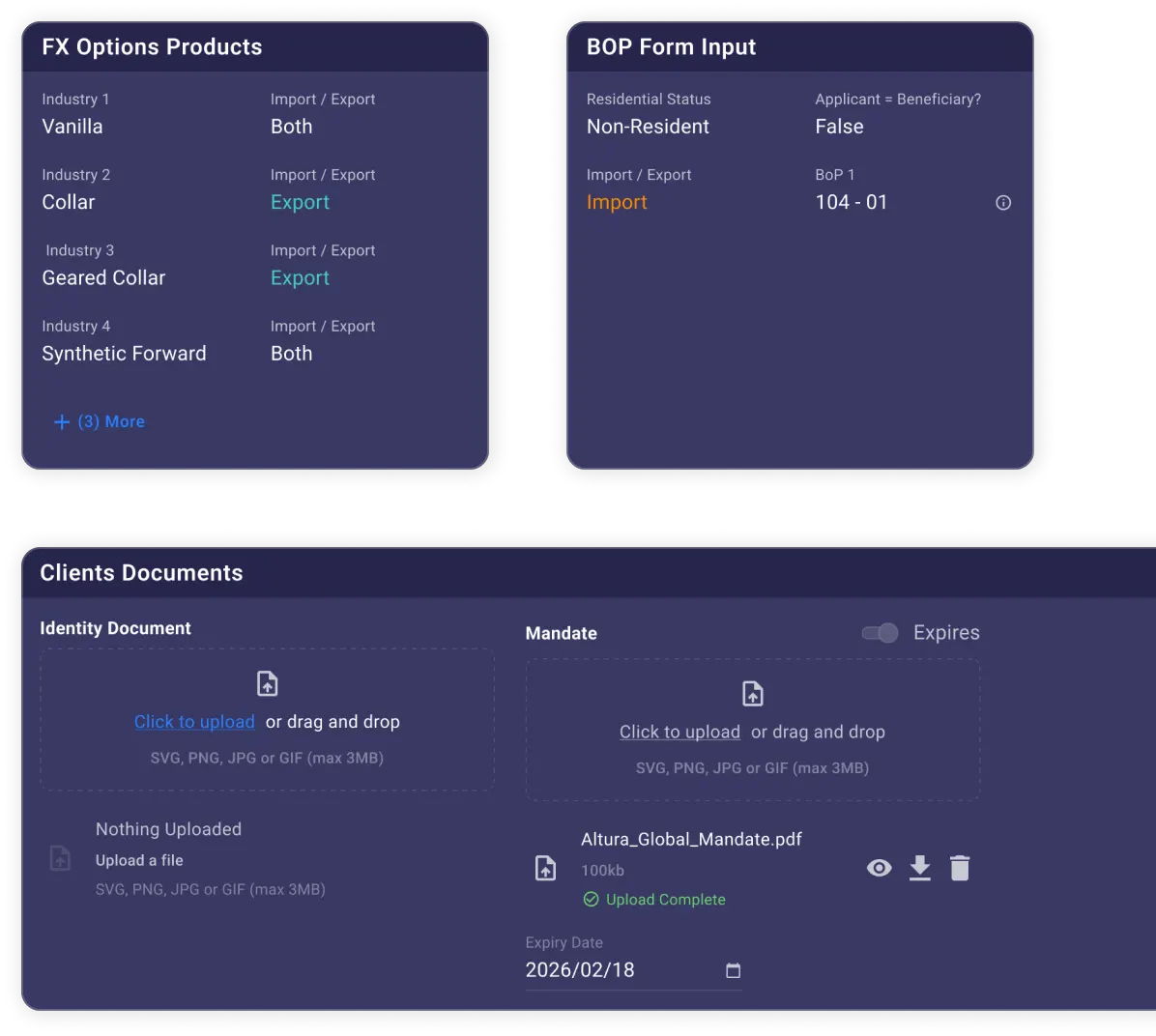

Manages all client and partner information, including contact lists, addresses, banking details, client facilities, and report distribution.

FXINTERMEDIARY UNIQUE ATTRIBUTES

FXINTERMEDIARY

UNIQUE ATTRIBUTES

Lifecycle

the FX Lifecycle

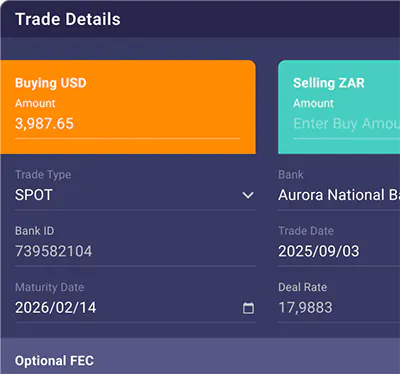

Automation of the entire FX workflow, from risk assessment to payment execution and partner management. This reduces errors, saves time, and enhances operational efficiency.

Reporting

and Reporting

Up-to-the-minute tracking of profits and losses across all currency pairs, enabling informed decision-making and proactive risk management.

Management

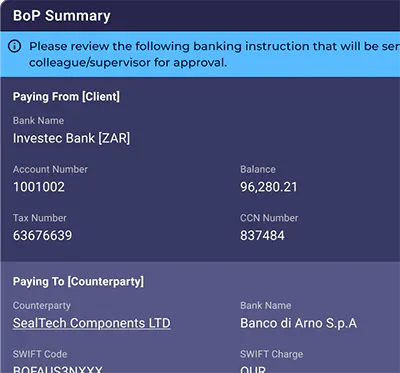

The platform streamlines compliance by automating regulatory reporting, including BOP forms, ensuring adherence to SARB requirements with minimal manual effort.

Compliance Management

The platform streamlines compliance by automating regulatory reporting, including BOP forms, ensuring adherence to SARB requirements with minimal manual effort.

All Stakeholders

Access For All Stakeholders

Enables real-time, role-based access for clients, intermediaries, and agents—driving transparency and collaboration while protecting sensitive data.

Effective Solution

Built on a cloud-native architecture, FXFlow offers scalable solutions with usage-based pricing, making it adaptable to businesses of all sizes without unnecessary overhead.

OTHER OFFERINGS

Automation of FX Payment Execution

Streamline FX transactions with seamless bank integration, minimise documentation transfers, and eliminate double data handling.

Real-Time FX Risk Management

Make smarter, data-driven decisions by tracking exposures and managing

hedging activities in a dynamic, real-time environment.

PARTNER WITH FXFLOW

FXFlow is part of the 42Markets Group, a specialist FinTech Group, whose companies have decades of experience and deep expertise in Trade and Treasury in Financial and Capital Markets.

FXFlow is part of the 42Markets Group, a specialist FinTech Group, whose companies have decades of experience and deep expertise in Trade and Treasury in Financial and Capital Markets.