FXPAY

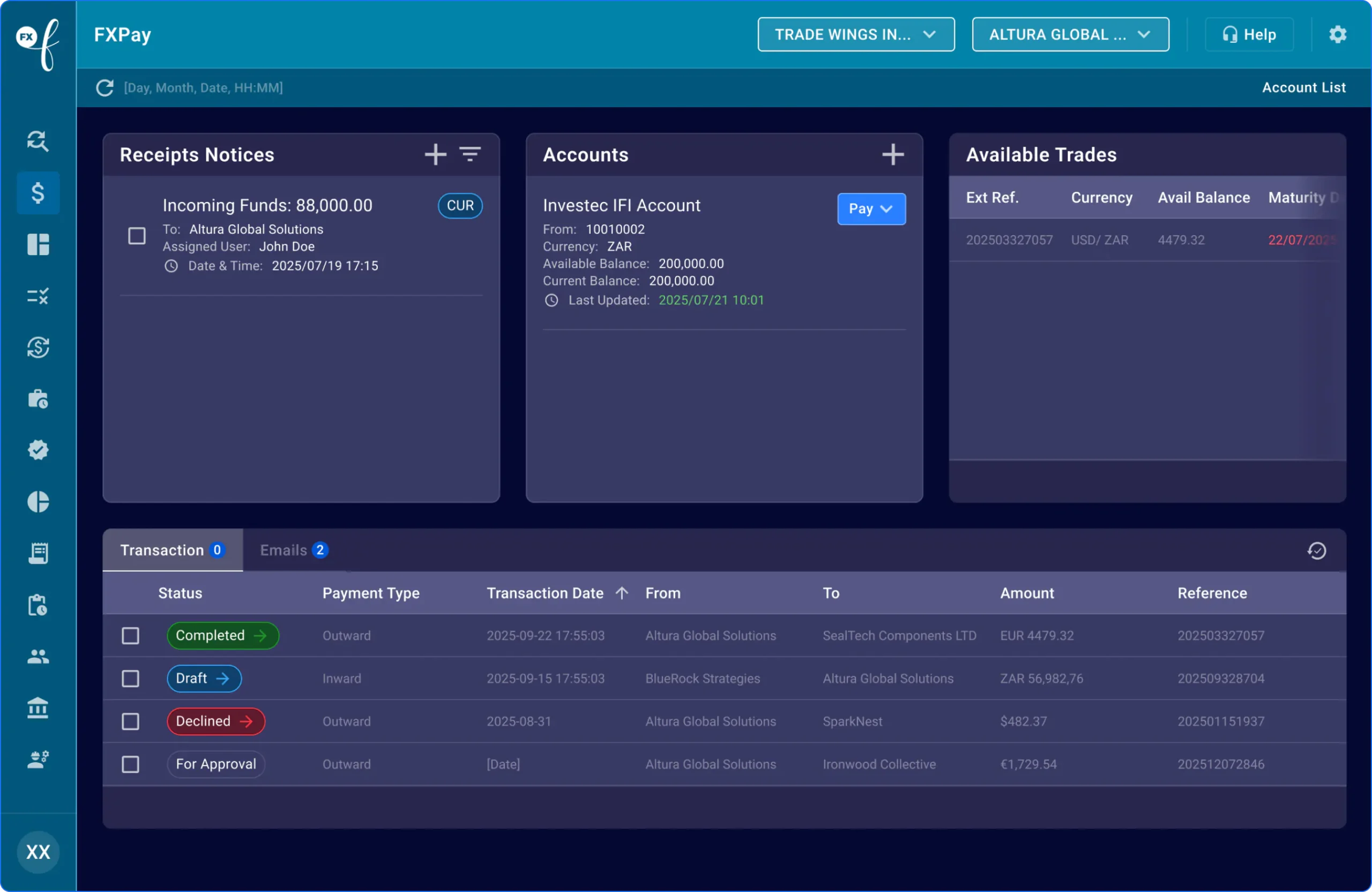

Enabling TOCs to capture, validate, and process foreign currency payments and receipts within a single, automated workflow.

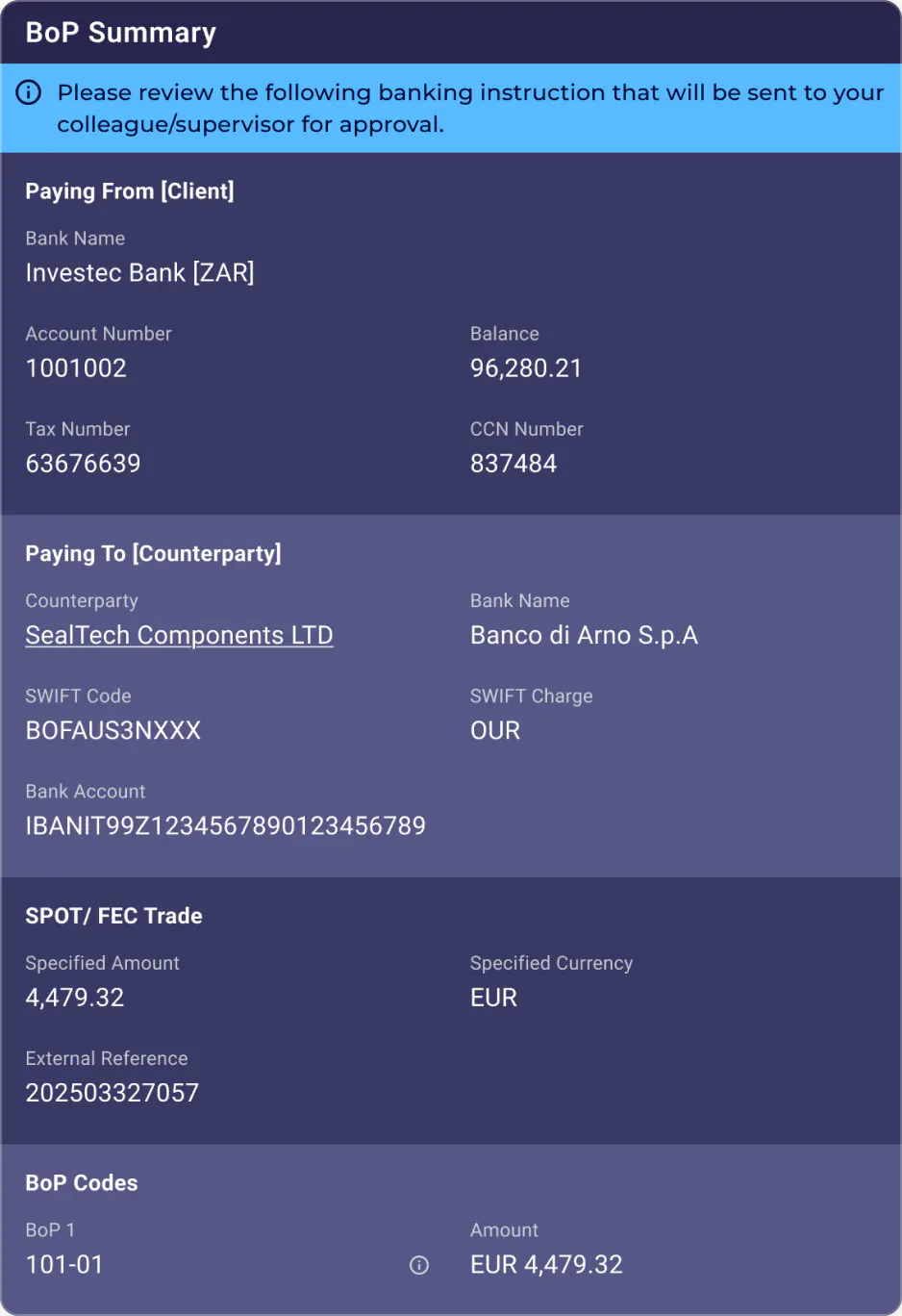

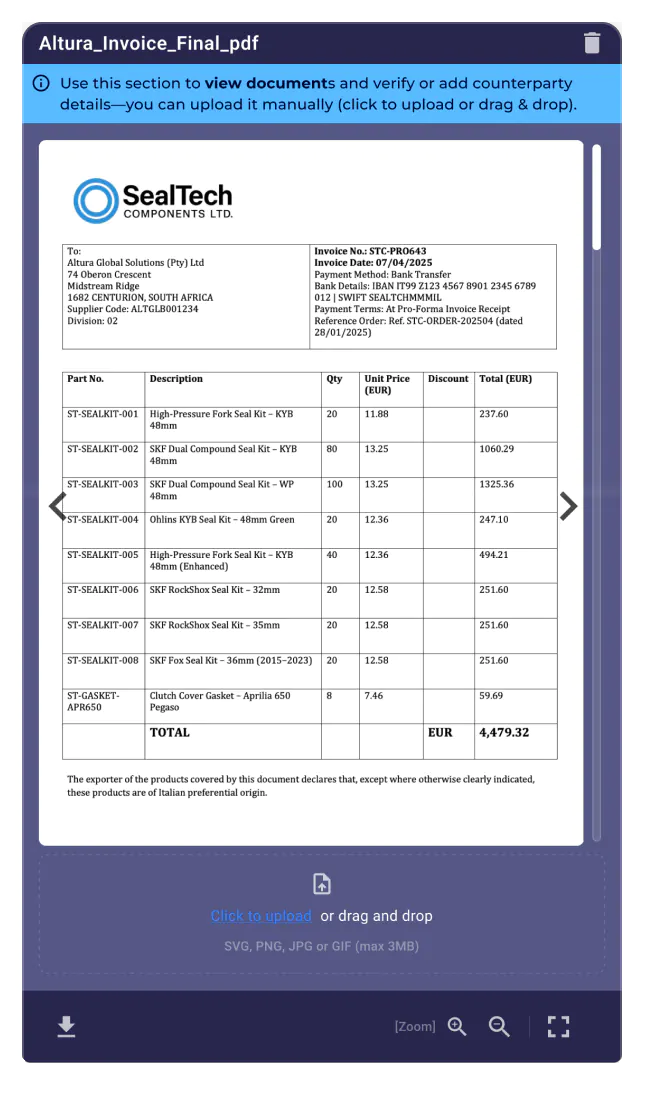

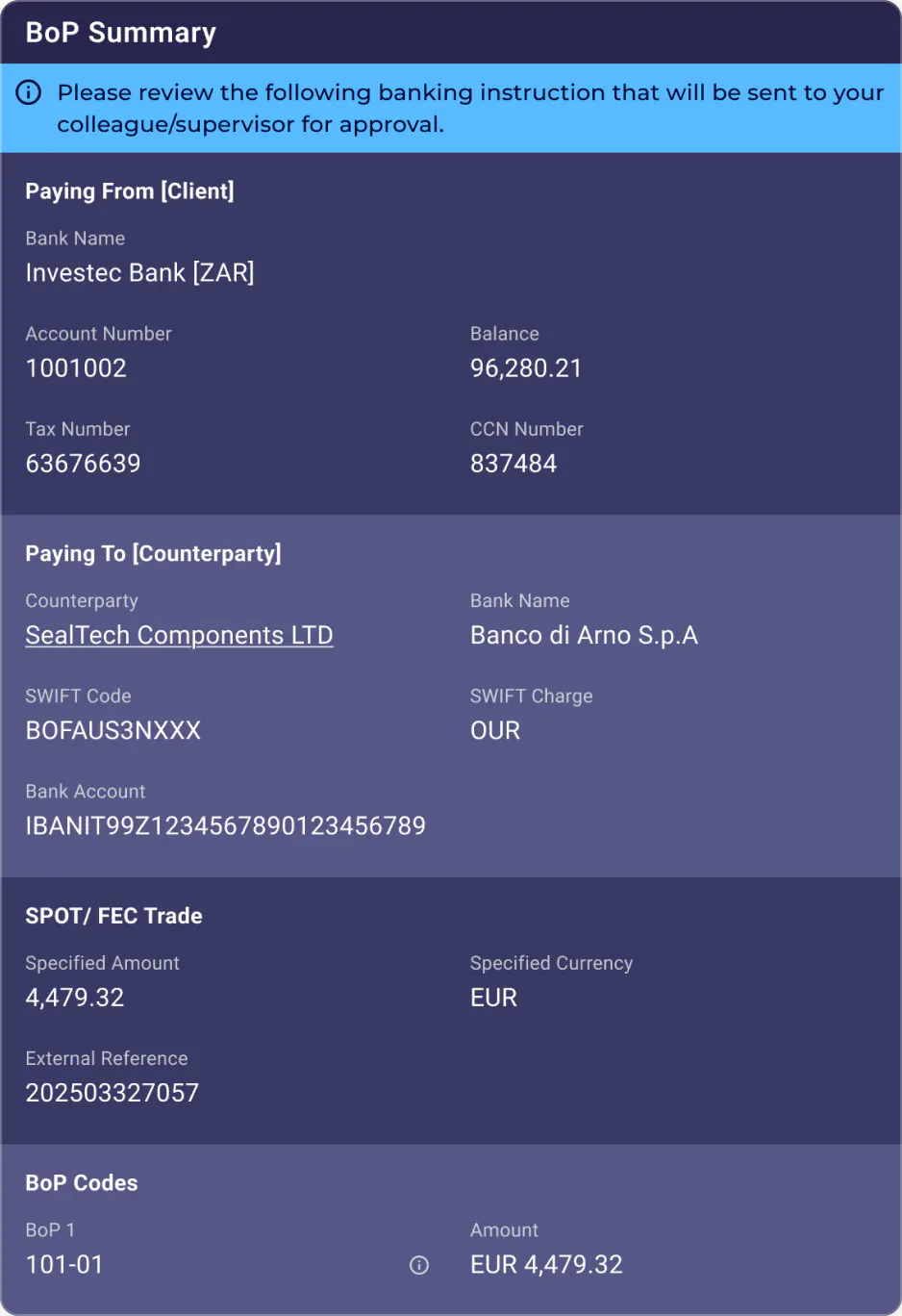

It streamlines operational processes, reduces manual errors, ensures compliance with SARB and BOP regulations, and supports integration with select banking partners to enable faster, more reliable transaction processing.

FXPAY

Enabling TOCs to

capture, validate, and

process foreign currency payments and receipts within a single, automated workflow.

It streamlines operational processes, reduces manual errors, ensures compliance with SARB and BOP regulations, and supports integration with select banking partners to enable faster, more reliable transaction processing.

FXPAY KEY BENEFITS

FXPAY

KEY BENEFITS

Notifications

Receipt Notifications

Be instantly notified when foreign currency funds are received by the bank, helping TOCs take timely action and improve client responsiveness.

Access up-to-date balances on client accounts directly within FXPay, supporting accurate decision-making and reconciliation.

of Payments and Receipts

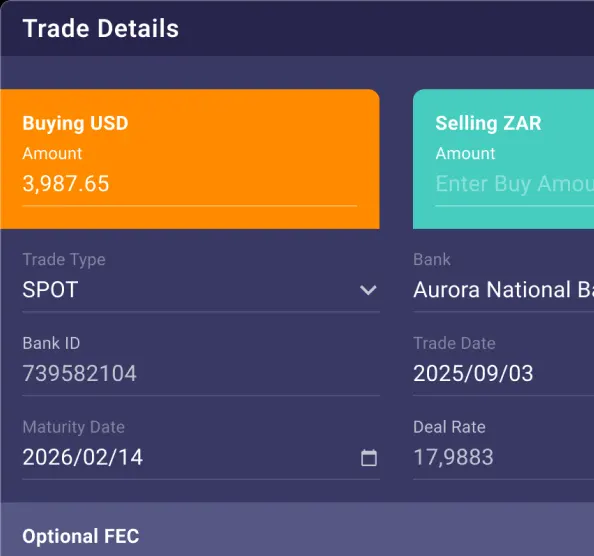

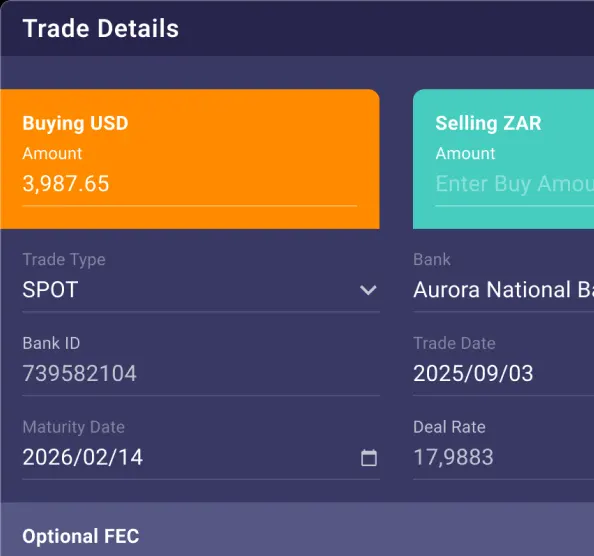

Streamline the full lifecycle of cross-border transactions—capture, validate, submit, and monitor both foreign payments and inward receipts from one central module.

Management

Easily maintain and assign beneficiaries at both the client and processing organisation level, with tools that support reuse, tracking, and validation of counterparty data.

FXPAY UNIQUE ATTRIBUTES

FXPAY

UNIQUE ATTRIBUTES

Recipient Reuseability

Store, manage, and reuse beneficiary details across payments, avoiding re-entry each time. This saves time and reduces data entry errors.

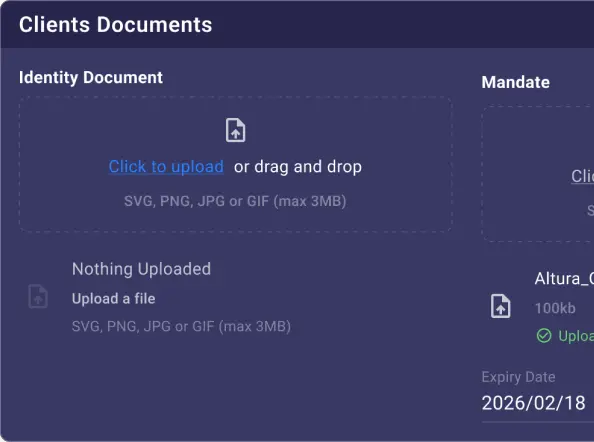

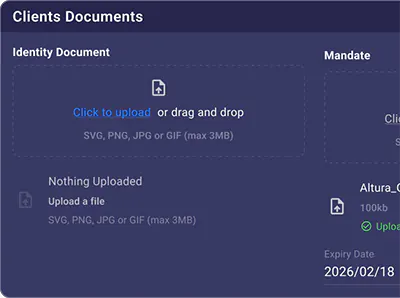

Documents

Automatic inclusion of frequent reused documents when submitting payments, eliminating constant manual attachment.

Framework

Set up and manage counterparties at the processing organisation level, enabling multiple clients to use shared recipients — ideal for high-volume TOCs handling retail or investment flows.

OTHER OFFERINGS

Real-Time FX Risk Management

Client and Consolidate Views

Efficient client handling, seamless partner management, and automated billing – freeing you to focus on delivering value.

PARTNER WITH FXFLOW

FXFlow is part of the 42Markets Group, a specialist FinTech Group, whose companies have decades of experience and deep expertise in Trade and Treasury in Financial and Capital Markets.

FXFlow is part of the 42Markets Group, a specialist FinTech Group, whose companies have decades of experience and deep expertise in Trade and Treasury in Financial and Capital Markets.